$1.6B+ INVESTMENT PORTFOLIO FOCUSED ON DRIVING AFFORDABLE HOUSING & JOB CREATION

SDS’s $1.6 billion+ portfolio—spanning six distinct funds and products—reflects our steadfast commitment to aligning financial performance with meaningful outcomes in communities. Every investment we make is guided by our core mission: helping institutional investors achieve their financial goals while fostering long-term community benefit.

FEATURED VIDEOS

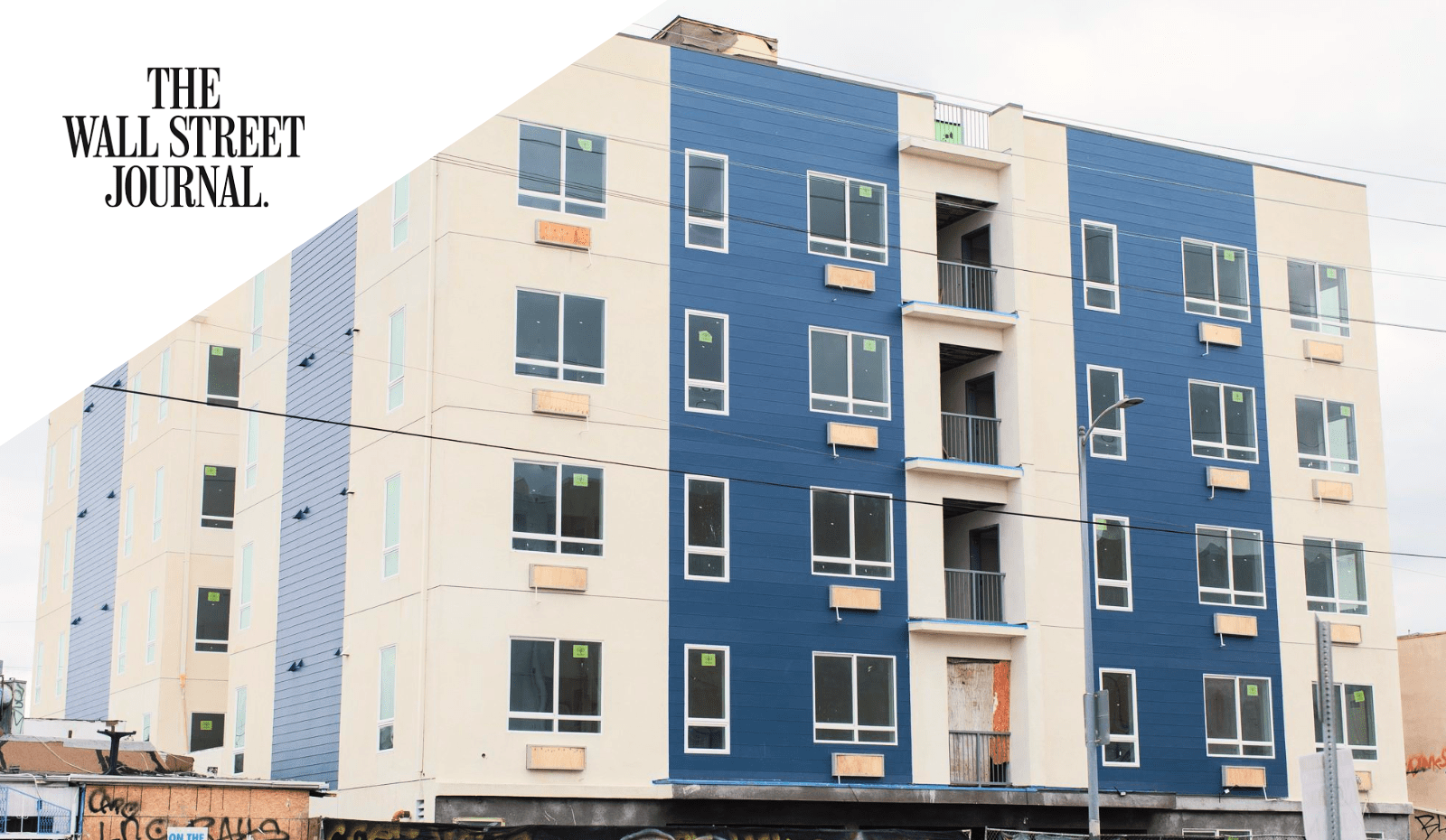

SDS SUPPORTIVE HOUSING FUND

An Investment Approach to Housing those Suffering from Homelessness in California

INITIATIVE HIGHLIGHTS

SDS SUPPORTIVE HOUSING FUND

An Investment Approach to Housing those Suffering from Homelessness in California

SDS MAKING A DIFFERENCE

30%

Average poverty

rate of communities

in which SDS Invests

$4B+

Total project costs across SDS portfolio

9,200+

Affordable, workforce & permanent supportive housing units financed

17,270

Jobs created

16

Investments in rural communities creating 3,081 jobs