About our Journey

SDS Capital Group, founded by Deborah La Franchi 2001, is a pioneer and leader in the field of affordable housing and economic development investing. SDS currently manages over $1.6 billion (with $1 billion exited) in assets across a portfolio of eight product lines, each with a distinct geographic and asset focus. All are structured to achieve risk-adjusted market-rates-of-return. SDS’s mission is to promote economic development and create affordable housing throughout some of the most… underinvested communities in the United States. SDS has been recognized by the ImpactAssets as a Top 50 Emeritus Manager for its financial results and community impacts. Through its family of innovative funds, SDS has helped support the creation of more than 25,000 jobs and 6,500 low-income or permanent housing units nationwide. Read More Read Less

$3.1B

Total Project Costs

$1.6B+

Assets under management

$2.4B

All-time Assets under management

47

Institutional Investors to date

Why Partner with Us

Financial

Stewardship

Over $1.6 billion of current assets under management. Each fund targets returns based on the level of risk and market expectations for similar non-impact strategies.

Proven

Track Record

20+ Years of Successful Investing. Eight-member management team with over $11.9 billion of investment and real estate experience.

Making a

difference is in our DNA

110 Total SDS Investments. Every investment benefits low-income communities and people. Recognized by the ImpactAssets 50 designation every year since 2018 for our financial performance and investments in low-income communities.

Our Partners

From investors and developers to co-fund managers and non-profits, our partners are instrumental in bringing the SDS vision to life.

I want to thank, of course, the people that are making this possible to provide the capital and to provide the building and also those that are going to take care of the homeless folk as they transition into housing…

it really hurts us to think of these poor families, poor children hungry.

DOLORES HUERTA

American Labor Leader and Civil Rights Activist

The South Dallas project aligns perfectly with the company’s focus and partnership with American South Real Estate Fund because it will bring “lasting change,” to an area in need of economic development.

EMMITT SMITH

Chairman, E Smith Advisors;

NFL Hall of Fame Player and Philanthropist

SDS - Making a Difference

Impact Investing.

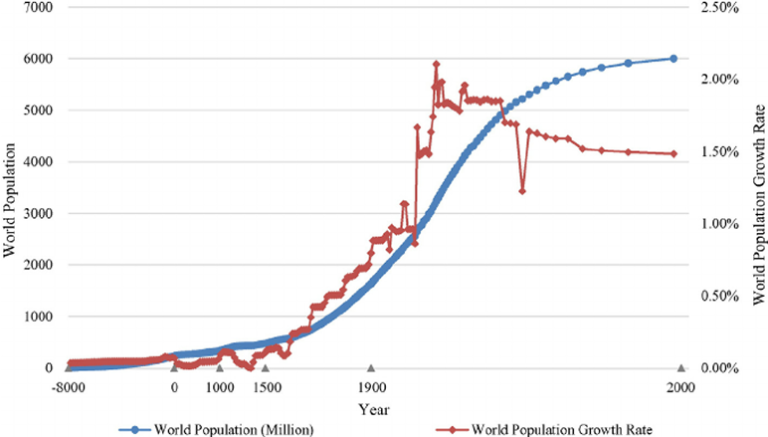

Growth over time, the time is now.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation.

Partner Insights

Mark McDaniel

President and CEO, Cinnaire

What has made for a successful partnership between Cinnaire and SDS?

“It really comes down to the high skill set of intelligence [and] creativeness matched with this passion, really from the heart of making our communities better places to live and raise your family.”

Partner Insights

David Alexander

Co-Owner and Managing Partner, Vintage Realty Group

We’ve made some great investments in the South. The returns are looking strong and because of all this, we’re now off and running on fund number two. Fund number two will be much larger. We’ll continue to be able to make these great investments in the South because of all the relationships with SDS — this has just been tremendous.

Partner Insights

Principal, Olive Tree

We were really looking for a partner who aligned with our mission and goals to provide and preserve scaled affordable housing throughout the United States. ASREF is a very sophisticated and thoughtful partner, which makes working together and redeveloping projects very smooth.

Partner Insights

Mark McDaniel

President and CEO, Cinnaire

What has made for a successful partnership between Cinnaire and SDS? <br>

“It really comes down to the high skill set of intelligence [and] creativeness matched with this passion, really from the heart of making our communities better places to live and raise your family.

Partner Insights

Belden Hull Daniels

CEO & Founder, Economic International

What an extraordinary opportunity for me to be in partnership with a wonderful woman…You and Los Angeles produced this extraordinary diversity of people from so many different ethnicities and backgrounds and life experiences that created a great firm and made a great partner for me to work with.

Partner Insights

Tim Roth

CEO, RMG Housing

The most standout attribute of SDS is their willingness to be involved [in a project], but they don’t take it partway. They take it all the way, with everything and every aspect, they’re looking to cover what’s needed to be accomplished for the success of the objective — not just their part of it.

Partner Insights

Mo Zahrawi,

CFO & COO RMG Housing

I compare our relationship with SDS to that of a company that is receiving venture capital money. A VC fund provides much more value than just providing capital. They help with key hires and assistance, in forming strategic relationships and assist with helping the company grow. That’s really the value that SDS has brought to RMG housing.