LOS ANGELES—State and local governments in California have committed tens of billions of dollars to build more affordable housing. A new complex for some of the neediest low-income people doesn’t use any of it.

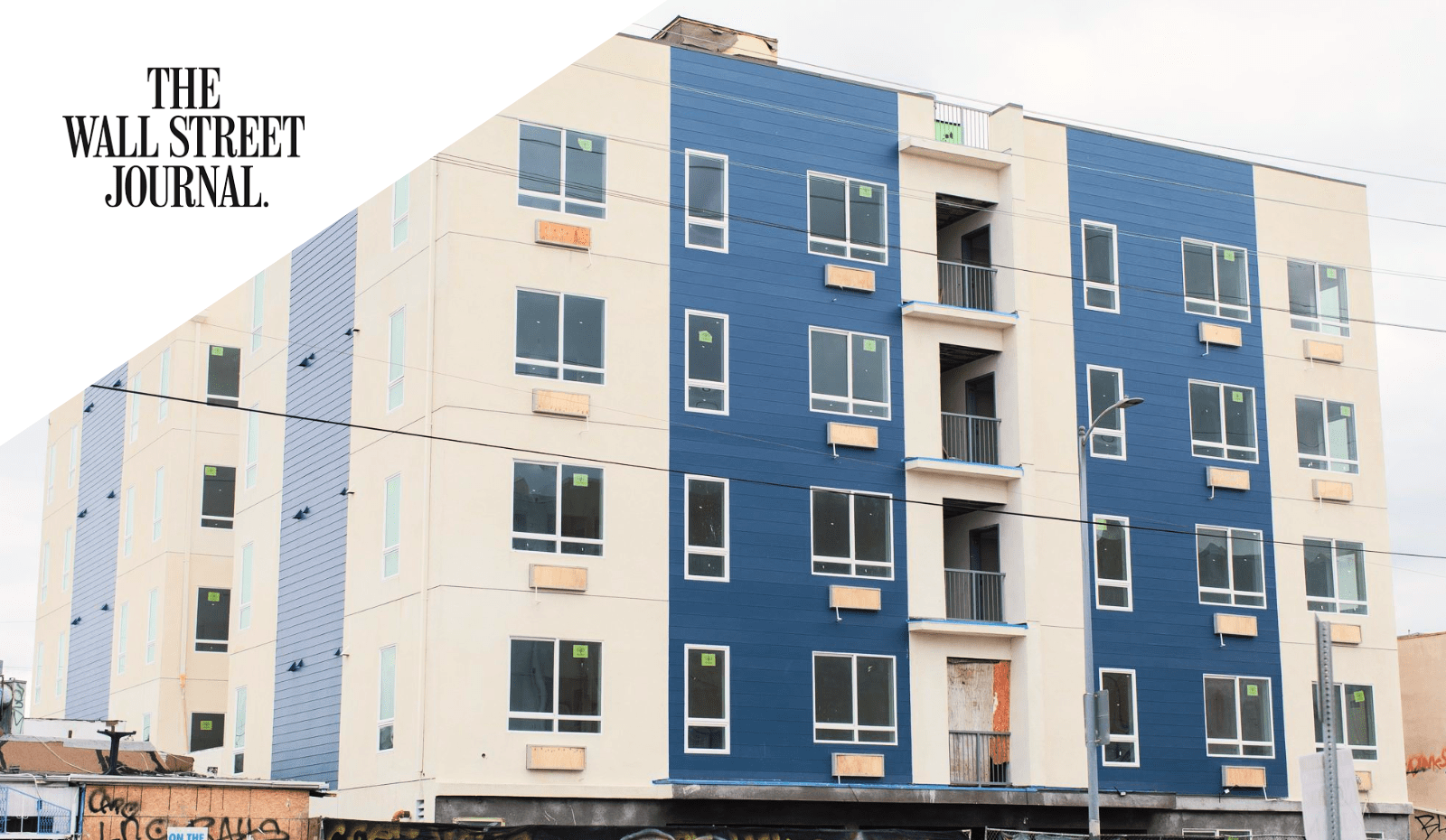

By forgoing government assistance and the many regulations and requirements that come with it, SDS Capital Group said the 49-unit apartment building it is financing in South Los Angeles will cost about $291,000 a unit to build.

The roughly 4,500 apartments for low-income people that have been built with funding from a $1.2 billion bond measure L.A. voters approved in 2016 have cost an average of $600,000 each.

SDS, an investment firm, is financing construction of its L.A. building, scheduled to open in June, with a $190 million fund it raised to build an estimated 2,000 units for formerly homeless people in the city with mental-health and other medical needs. It is one of several such efforts venturing into an affordable-housing market that for decades has been dominated by developers and nonprofits that cobble together public funding and typically move at a snail’s pace.

“We believe there’s a different way than using government money, which really becomes slow and arduous and increases cost,” said Deborah La Franchi, chief executive of SDS.

Some affordable-housing veterans worry whether privately funded construction can scale quickly enough to match the scope of the homelessness problem and whether its backers will maintain their commitments to serve the needy.

Nearly everyone involved in California housing agrees that the state desperately needs more affordable units. After L.A. voters approved the 2016 bond measure intended to reduce homelessness, the number of people living on the streets grew 60% to 46,260 people last year. California is home to more than 181,000 homeless individuals, roughly a third of the national total.

Publicly funded affordable housing must typically be built with labor agreements that dictate construction wages and working conditions, as well as energy-efficiency standards. Funding often comes from a variety of agencies, each of which has its own set of approvals and regulations that can slow construction and add to costs.

With private financing, “You’re cutting out millions of dollars just in soft costs,” said David Grunwald, an executive at RMG Housing, which is developing the SDS fund’s projects.

To build affordable housing, SDS raises what is called an impact fund, a relatively low-return private-equity fund with backers that include banks and foundations. Most of these institutions are required by federal laws to make some investments that benefit low-income communities. Major investors in the firm’s $190 million fund include Ally Bank, Synchrony Bank and Kaiser Permanente.

Though construction doesn’t use public financing, many privately funded buildings would likely still depend on government funds to operate. Formerly homeless residents at SDS financed properties, for example, are expected to use federal housing vouchers or other rental assistance to pay rent. The properties can also qualify for property-tax exemptions.

SDS executives said there are currently more than enough housing-assistance vouchers available to support its pipeline of projects in Los Angeles. At any given time, there are more than 1,000 unused tenant vouchers in Los Angeles, according to the city housing authority, in part because some landlords don’t accept them.

Privately financed affordable-housing projects also benefit from recent changes in state law and local regulations that have streamlined approvals and raised unit maximums for projects serving low-income residents, transit-rich neighborhoods and the homeless population.

Green Development Co., a housing developer, is planning four unsubsidized affordable apartment buildings in Los Angeles, primarily for people with incomes no higher than 80% of the local median. The largest is 190 units and set for a site where only 10 market-rate units would be allowed under zoning laws. The larger scale makes the project more profitable than if it had built 10 market-rate housing units instead, said Andrew Slocum, principal at Green Development.

“The return gets better, and the project provides more housing as well,” said Slocum, who expects the cost per unit of his planned projects to average $222,000.

Some researchers who study affordable housing said they worry whether buildings will be properly kept up in the long run by private firms looking to maximize profits from renters with few other options.

“The required returns to capital could really influence what happens at the property, everything from investment in the physical building, but also the amount of attention and care that is paid to residents,” said Carolina Reid of the Terner Center for Housing Innovation at the University of California, Berkeley.

Advocates have also questioned how many buildings reliant on renters with housing vouchers can be sustained unless the federal government greatly increases funding for them.

“A lot of local housing authorities are running very low on voucher authority,” said Welton Jordan, chief real estate development officer at EAH Housing, an affordable builder that builds with federal tax credits.

The most significant impact private affordable-housing builders could have, some advocates agree, is to demonstrate how much cheaper construction can be.

Jennifer Hark Dietz, chief executive of the nonprofit housing developer PATH, said she is hopeful the private-equity model will inspire governments to simplify requirements and bring costs down. Her organization is currently working on a project in the Bay Area that blends private-equity funding with public subsidies.

“I don’t think any of us want to be doing it the way that it has been done,” she said.

Write to Christine Mai-Duc at christine.maiduc@wsj.com and Will Parker at will.parker@wsj.com