PRESS RELEASES

R.H. Ledbetter Properties Secures $15M Equity Investment from ASCP for $49M Attainable Housing Development in Greater Atlanta Metro

R.H. Ledbetter Properties Secures $15 Million Equity Investment from ASCP to Develop $49M 236-Unit Attainable Housing Community in Greater Atlanta Metro

American South Capital Partners Closes on $76M Atlanta Affordable Housing Project

Woodfield Development and American South Capital Partners Finalize Land Closing for $76M BeltLine Project Bringing Affordable Housing to Atlanta’s Westside

Since 2006, NNMF – Managed by SDS Capital Group – has financed 51 projects providing $752M of direct investment, creating and preserving more than 15,000 rural and urban jobs in distressed communities

New 278-Unit Project to Deliver Workforce Housing in High-Demand Urban Core

Real Estate Fund Manager American South Capital Partners (“ASCP”), a joint venture between SDS Capital Group and Vintage Realty Company, has successfully completed the first closing of its newest affordable housing investment vehicle, American South Real Estate Fund III (“ASREF III”), securing $60 million in initial capital commitments toward its $500 million target.

R.H. Ledbetter Properties Secures $15 Million Equity Investment from ASCP to Develop $49M 236-Unit Attainable Housing Community in Greater Atlanta Metro

Woodfield Development and American South Capital Partners Finalize Land Closing for $76M BeltLine Project Bringing Affordable Housing to Atlanta’s Westside

American South Capital Partners and VPG Holdings form Financing Partnership to Acquire 250-Unit Low-Income Housing Property in New Orleans.

An Asset Backed Financing Business Line that will Provide Debt to Affordable Housing Developers Across the United States

ASREF II closes its latest $18.75 million in American South affordable housing portfolio

$174M ASREF II closed financing for the construction of 336-unit workforce housing complex in Austin Metropolitan Area

$174M ASREF II closed financing for development of 168-Unit affordable housing complex in Charlotte, NC

$174M ASREF II closed financing for development of 280-Unit workforce housing complex in Beaufort, SC; Third time working with Piedmont Private Equity

National New Markets Fund invests $17.5M into Rich Products Manufacturing Facility; 132 jobs coming to plant in Brownsville, TX

An Asset Backed Financing Business Line that will Provide Debt to Affordable Housing Developers Across the United States

2022 Impact Fund Listing Recognizes Deep Impact and Innovative Managers Across the Globe

First-of-its-kind Private Equity Impact Fund to Finance 1,800 Permanent Supportive Housing Units in California. SDS Supportive Housing Fund Will Maximize Private Capital Impact on Homelessness with Per-Unit Costs Below $200,000.

Private capital investment into permanent supportive housing projects, like this new apartment complex, offer viable solutions to address the affordable housing and homelessness crises.

American South Real Estate Fund II Close to Benefit Economically-Distressed Communities Across the South.

For the third consecutive year, SDS Capital Group has earned a spot on the ImpactAssets 50 list, which serves as the industry’s leading database of impact investors.

An Asset Backed Financing Business Line that will Provide Debt to Affordable Housing Developers Across the United States

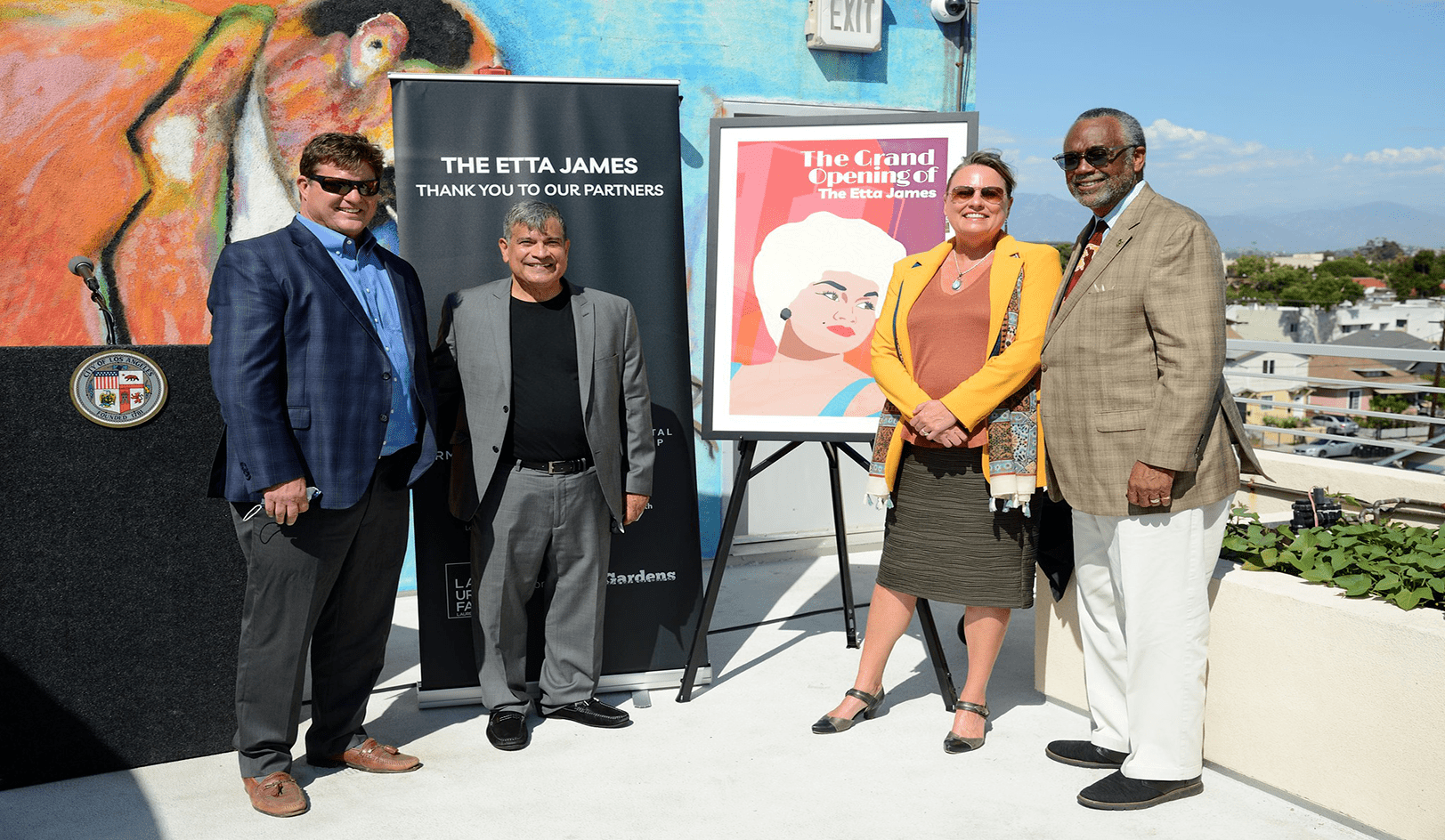

SHF’s first completed permanent supportive housing building officially opened its doors at a ribbon-cutting ceremony featuring civil rights leader and building namesake Dolores Huerta, Mayor Karen Bass, Councilmember Curren Price and SDS CEO Deborah La Franchi.

The acquisition of the 429-unit, affordable community, The Life at Lakeside Villas, formerly known as Village at Greenfield Apartments, is ASFM's second project in North Carolina

SDS Supportive Housing Fund’s collaboration with partner RMG Housing and Bethel A.M.E. Church in South Los Angeles celebrated in a groundbreaking ceremony featuring Church leadership, Councilmember Marqueece Harris-Dawson and Congressmember Karen Bass

SDS Capital Group’s Impact Fund to Finance RMG Housing Construction of 75 Units for Individuals Experiencing Homelessness; Expanding Reach Beyond Los Angeles Region

Innovative Partnership Between the SDS Supportive Housing Fund, RMG Housing and Southside Bethel Baptist Church to provide 47 Units of PSH in South LA.

$7 Million Modular Housing PSH Project Is Third Investment by New Fund in Public-Private Partnership with RMG Housing and the City of Los Angeles

SDS Supportive Housing Fund Finances Construction of 40 Units of Permanent Supportive Housing in South Los Angeles

The SDS Supportive Housing Fund’s first investment closed on February 7th, 2020. Located south of downtown Los Angeles, RMG purchased the site in 2016.

Partners ZNE Capital and LeavenWealth to use the total $27.8M project investment to make significant structural and electrical repairs as well as install solar paneling throughout the complex. Units will be rented at rates affordable at 80% AMI bringing critically-needed workforce housing to the region.

The Preserve At Flagler Beach will offer much-needed quality affordable housing to Florida community.

The Life at Elmwood Grove” development will renovate 192 affordable multifamily housing units in Springdale, AR. This 4th partnership between ASREF and Olive Tree raises the total of affordable housing units developed to 1,052.

SDS Capital Group & Vintage Realty Company announce $4.8 million investment in 234-unit affordable housing for seniors/families.

Since 2006, NNMF – Managed by SDS Capital Group – has financed 51 projects providing $752M of direct investment, creating and preserving more than 15,000 rural and urban jobs in distressed communities

National New Markets Fund invests $17.5M into Rich Products Manufacturing Facility; 132 jobs coming to plant in Brownsville, TX

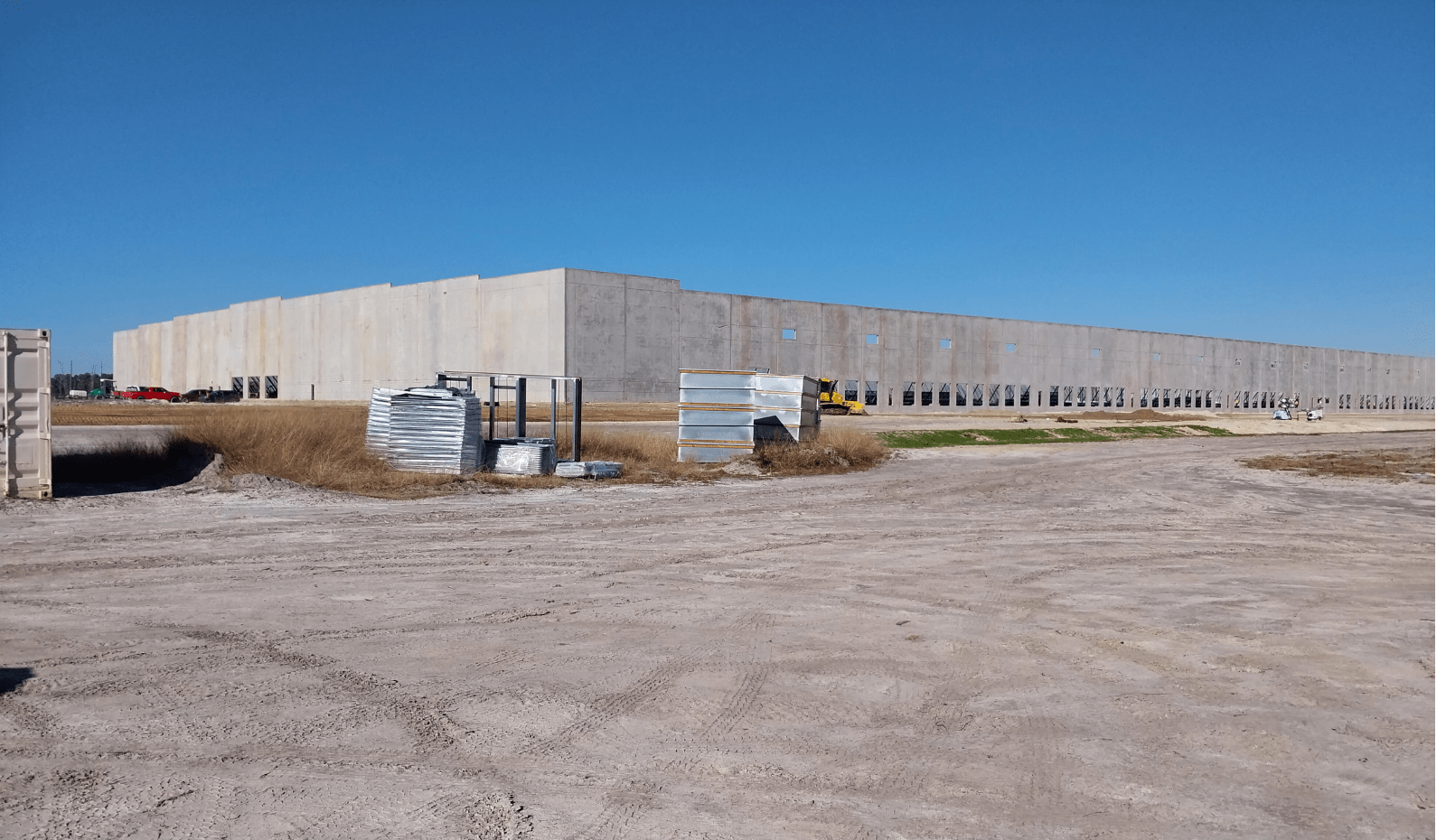

NNMF Invests $17.5M in Charles Komar & Sons; 300 jobs coming to distribution center in Ellabell, GA

NNMF Invests $17.5M in New Markets Tax Credit Financing for Minnesota-based Dairy Co-Op; 267 Small and Family-Owned Farms Benefit

National New Markets Fund Provides $18M in NMTC Financing for South Carolina-based Company; 95 New Jobs Coming to Food Processing Plant