ELLABELL, GEORGIA (March 5, 2024) – National New Markets Fund, LLC (“NNMF”), an affiliate of Los Angeles, CA-based SDS Capital Group, and the TD Community Development Corporation (TDCDC), a wholly-owned subsidiary of TD Bank, N.A., together have invested $25 million in New Markets Tax Credit (NMTC) allocation into Charles Komar & Sons, Inc. (“Komar”) distribution center expansion in Ellabell, GA. The cumulative local employment impact of Komar’s new plant is substantial, creating an estimated 300 full-time jobs.

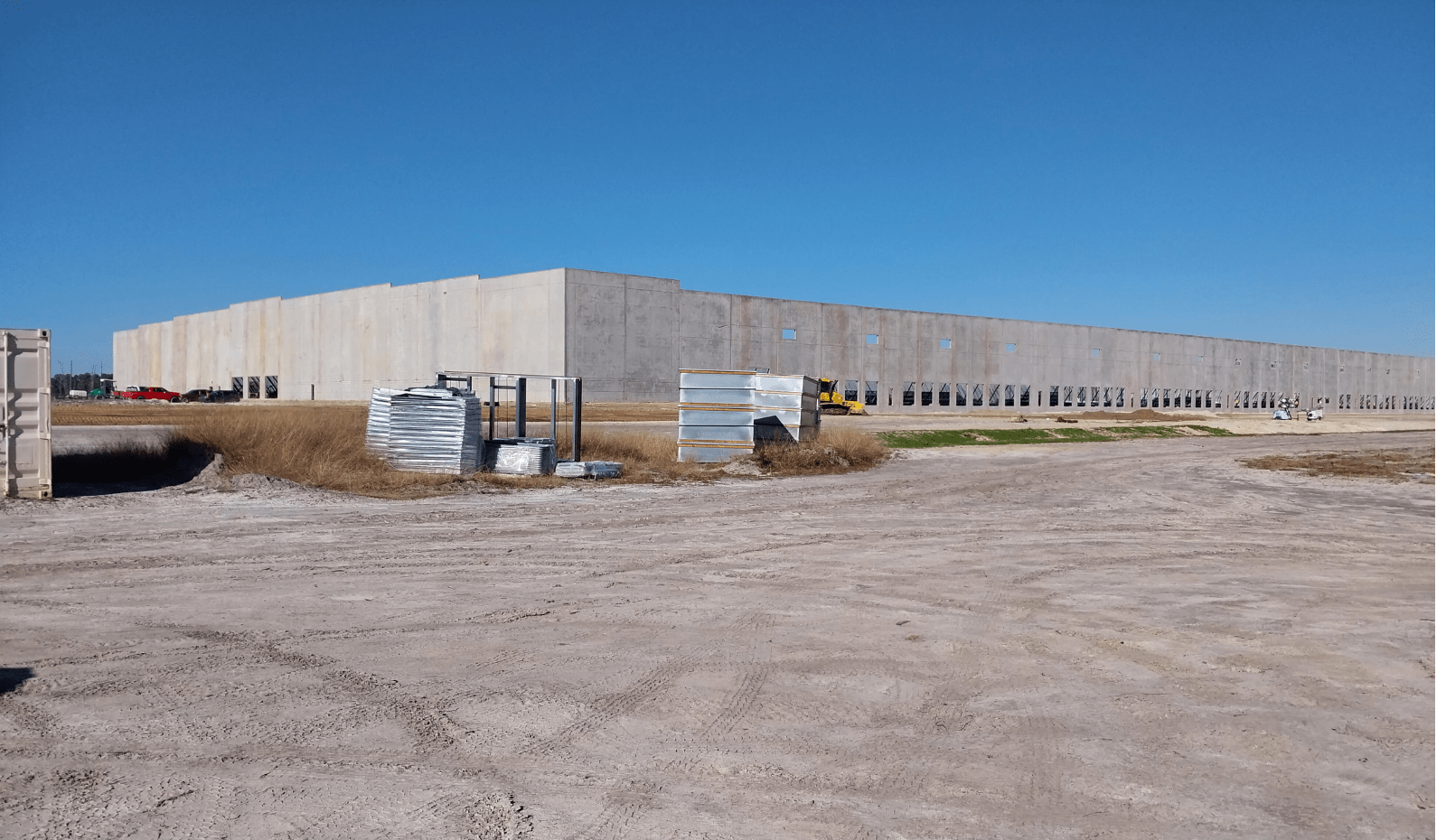

Komar is a 50% women-owned apparel manufacturer and distributor that works with more than 100 owned, licensed, and private label brands to produce 110 million garments annually. NNMF’s $15 million allocation, coupled with TDCDC’s $10 million allocation, will fund the equipment at Komar’s new 765,000 SF e-commerce and distribution center in Ellabell, GA.

The investments utilize capital from the NMTC program administered by the U.S. Treasury Department. Investment groups, such as NNMF and TDCDC, compete annually to receive NMTC awards. These selected allocatees sell the tax credits to institutional investors, using the proceeds to invest in projects benefiting low-income communities – such as Komar’s new plant.

“The New Markets Tax Credit program was critical to our ability to fund this new manufacturing and distribution site,” said Komar Chief Financial Officer, Harry Gaffney. “Thanks to these NMTC allocatees, we are bringing hundreds of quality, full-time jobs into our Savannah community.”

“The economic benefit from Komar’s creation of this new plant is immense,” said Deborah La Franchi, CEO, National New Markets Fund. “Not only is this a women-owned company—a rarity in the industry – but 300 new, quality jobs will be created with most positions not requiring any advanced degree.”

Komar received the NNMF allocation as part of a complex $25 million NMTC financing package. TD Bank is the investor purchasing the NMTCs from each of the participating NMTC allocatees: NNMF and TDCDC.

“We are proud to support Komar’s strategic expansion into Bryan County,” said Michael Cooper, President of TDCDC. “At TD, we’re committed to fostering economic development via projects that create quality and accessible jobs, and Komar, a third-generation family-owned business, is well-positioned to deliver on this shared commitment.”

About Charles Komar & Sons, Inc.

Komar was founded over a century ago, in 1908, around the guiding principle of ‘one reputation, real values,’ which continues to guide the company today. Komar is a trusted partner bringing deep expertise and a personalized approach to everything. As such, the company has become a global leader in apparel design, sourcing, manufacturing, and distribution. The company has demonstrated a history of creativity, innovation, customer service, and social responsibility. Komar was the first apparel company to introduce Nylon and Rayon fibers as stable figures in 1946. Additionally, the sponsor has completed a New Markets transaction previously and given generously to all the communities they operate. This culture of innovation and the development of products consumers and the community love have led the company to experience tremendous growth.

About National New Markets Fund

National New Markets Fund, LLC , founded in 2005, has invested $752 million (51 investments) of its New Markets Tax Credit allocation into projects located in the Great Lakes region and the

Deep South. Each investment has provided critical community services or quality jobs to high-distress communities – such as hospitals, charter schools, and food banks, as well as job-creating manufacturing expansions. In 2013, NNMF narrowed its focus to invest only in manufacturing and food-processing companies (26 companies total). This more focused strategy centers on creating quality jobs for the local residents of these distressed communities – both rural and urban. SDS Capital Group, the parent of NNMF, is a pioneer and national leader in impact investing. SDS’s founder, Deborah La Franchi, launched SDS in 2001 with a vision of creating a platform of impact funds that would attract and engage the private-sector in the battle against poverty. Today, SDS’s platform includes five distinct impact fund strategies ($1.3 billion current asset under management; additional $1.1 billion exited), with its direct investments having helped support the creation of over 25,000 jobs and over 6,500 low-income or permanent supportive housing units throughout the US.

About TD Community Development Corporation

TD Community Development Corporation (TDCDC) is a certified Community Development Entity and wholly-owned subsidiary of TD Bank, N.A. Since 2007, TDCDC has been a six-time award winner under the NMTC Program, securing $450 million in allocation authority from U.S. Treasury to support the revitalization of low-income, urban and rural neighborhoods across TD’s Maine to Florida footprint. To date, TDCDC has deployed $1.3 billion in direct and indirect investments to support 56 projects. TDCDC’s bifurcated deployment strategy helps commercial and industrial businesses create and retain high-quality, accessible jobs and helps community-based organizations improve and expand local services, resources, and facilities. In total, TDCDC’s NMTC investments have helped create over 8,700 direct jobs and expanded critical community services to over 137,000 low-income community residents.

CONTACT & MORE INFO:

Bruce Beck, bruce@dbrpr.com

MEDIA RESOURCES & DOWNLOADS: