DALLAS, TX – July 13, 2023 –Elizabeth Property Group (EPG) has closed on the acquisition of a portfolio of six Low Income Housing Tax Credit (LIHTC) apartment properties located in the Texas cities of Houston, Dallas-Fort Worth, Beaumont, Huntsville, Bryan-College Station, and Wichita Falls, TX. The portfolio totals 1,444 units of affordable housing with the capacity to house an estimated 3,000 tenants. Funds affiliated with American South Fund Management, LLC partnered with Dallas-based Elizabeth Property Group (EPG) to purchase and renovate the portfolio.

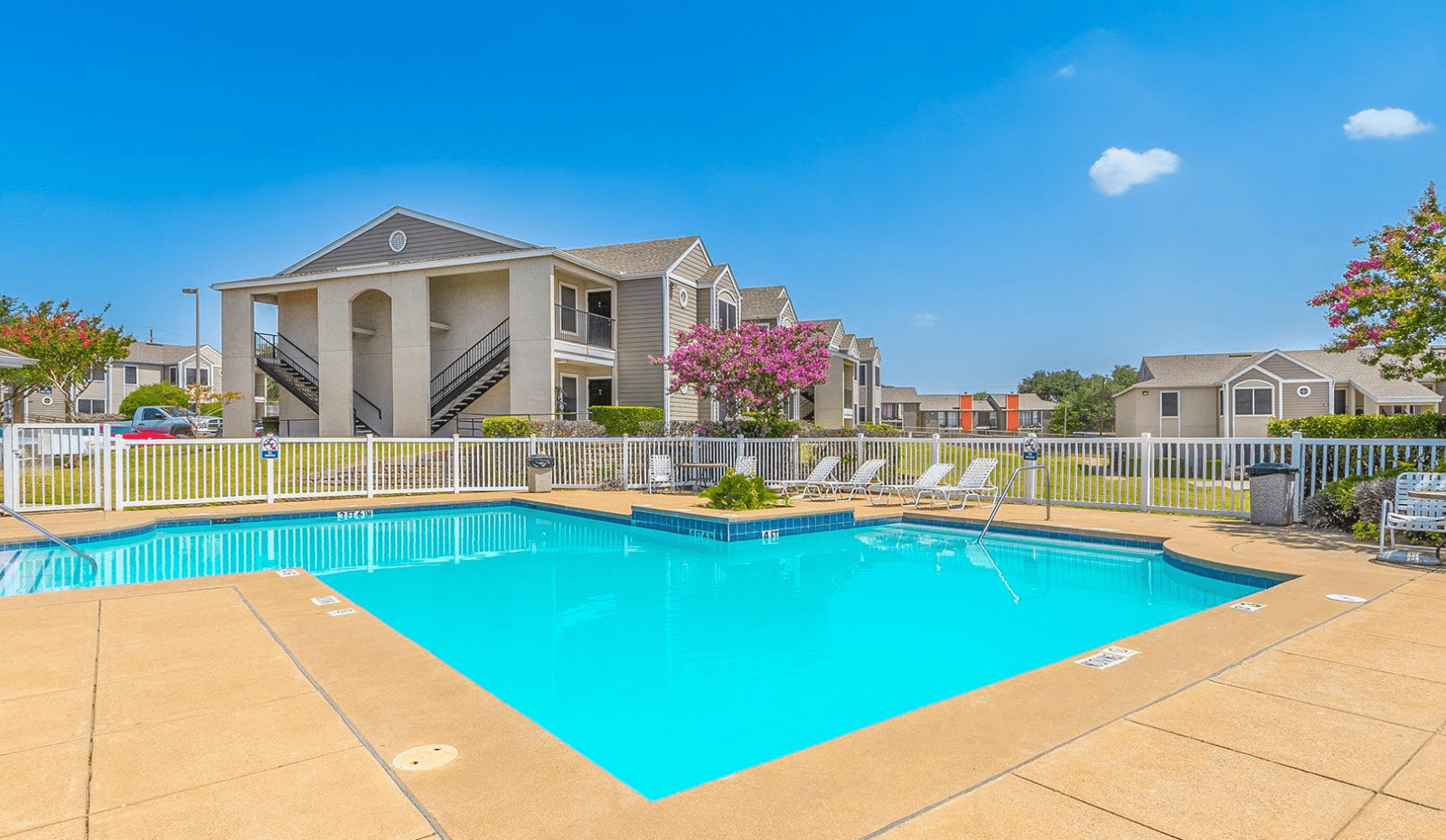

All units will continue to be affordable for renters at incomes less than 60% of the Area Median Income (AMI) through 2042 and 2043. Each of the developments is located in low- or moderate-income area with an average poverty rate of 36% and an average census tract minority population of 75%. Currently, 94% of units are occupied. Renovations will include deferred maintenance, painting, and replacing of flooring within units, exterior and landscaping upgrades, and additional offerings of after-school community programs within the complexes. No tenants will be displaced because of renovations.

The six investment properties located in the Dallas and Houston regions are: Willow Green in Houston (336 units); Woodglen Park I & II in Duncanville (232 units); Pine Club in Beaumont (232 units); Ridgewood West in Huntsville (232 units); Saddlewood Club in Bryan (232 units); Tealwood Place in Wichita (180 units).

“The Texas LIHTC Portfolio exemplifies Elizabeth Property Group’s mission of maintaining quality affordable housing for local residents,” said Tisha Vaidya, Co-Founder and Principal of Elizabeth Property Group. “We are thrilled to be partnering with ASFM once again to preserve critically needed affordable housing throughout Texas.”

“Preserving 1,444 affordable units for low-income Texans is the type of project that meets the core of our mission,” said Deborah La Franchi, ASFM Managing Partner. “Our funds’ investment with EPG ensures that all of these units will be LIHTC for the next 20 years.”

While Texas leads the US in population growth, housing development has not kept pace. The average increase in rent between 2020 and 2021 was 30% statewide reflecting demand and housing shortages. Over the past year, rents have risen 11% in Houston and 16% in Dallas. During the same time period, salaries for private industry workers have risen just 3.5% in Houston and 5.2% in Dallas, increasing the need for affordable housing.

“We are delighted to be investing with EPG in Texas again,” said David Alexander, ASFM Managing Partner. “EPG’s commitment to increasing and renovating affordable housing throughout Texas aligns with ASFM’s goals to support disadvantaged-income earners and spur local economic development.

Funds affiliated with ASFM are used to provide capital for impact investments located within distressed communities of color in its 10-state Southern footprint. Since 2018, ASFM’s impact funds have made 22 investments in Texas, Georgia, Florida, Alabama, North Carolina, South Carolina, Louisiana, and Arkansas totaling $96 million in equity investment. These investments have financed the renovation and development of approximately 5,000 housing units, 83% of which are low-income affordable units.

About Elizabeth Property Group: Elizabeth Property Group is a Texas-based affordable multifamily owner/operator focused on affordable acquisition/rehab properties. Founded by Moira Concannon and Tisha Vaidya in 2020, EPG’s principals have transacted on over $3 billion of commercial real estate including the acquisition, capitalization, and repositioning of ten multifamily properties in Texas. EPG targets affordable investments that require a physical or operational turnaround, and that have regulatory complexity and/or a scale that prevents larger more institutional affordable operators from participating. EPG is focused on preserving affordability, minimizing resident displacement, and creating better quality housing with social programming to help residents have a safe and healthy home.

[1] https://spectrumlocalnews.com/tx/austin/news/2022/08/03/texans-struggle-to-pay-skyrocketing-rent

[1] https://www.dmagazine.com/home-garden/2022/01/why-dallas-rent-is-increasing-2022/ & https://houston.culturemap.com/news/real-estate/houston-apartments-rent-prices-rising/

[1] https://www.bls.gov/regions/southwest/newsrelease/employmentcostindex_dallasfortworth.htm

About American South Fund Management, LLC

ASFM provides management services to real estate impact funds focused on investing in transformative projects in 10 states across the Southern U.S. ASFM is owned by Los Angeles-based impact fund manager SDS Capital Group (www.sds.capital) and Vintage Realty Company, a Shreveport, Louisiana-based property developer/manager (www.vintagerealty.com). SDS Capital Group manages five impact funds and has been selected the past five years as an ImpactAssets 50 investment manager. Founded in 1988, Vintage Realty Company is a leading multifamily real estate developer with more than 225 team members and projects located throughout the South. The partner firms leverage their combined real estate experience to finance transformative projects that benefit distressed communities of color throughout the South. ASFM’s impact funds have made investments in communities that are on average 81% minority and suffer from a poverty rate of 36%. For more information, visit asref.com.

CONTACT & MORE INFO:

Siobhán Stocks-Lyons Marino, Sstocks-lyons@marinopr.com, 212-402-3531

Sybil MacDonald, Marketing & Communications, sybil@marketing-comm.com, (323) 376-8961

MEDIA RESOURCES & DOWNLOADS:

Project Photos & Logos, Click Here

Additional SDS Press Info, Click Here