American South Capital Partners

Financing Affordable and Workforce Housing in the American South

Mission & Investment Focus

American South Capital Partners (ASCP) invests in affordable and workforce housing projects across the funds’ 10-state southern footprint. American South Real Estate Fund(s) I and II (ASREF I and ASREF II) are described below.

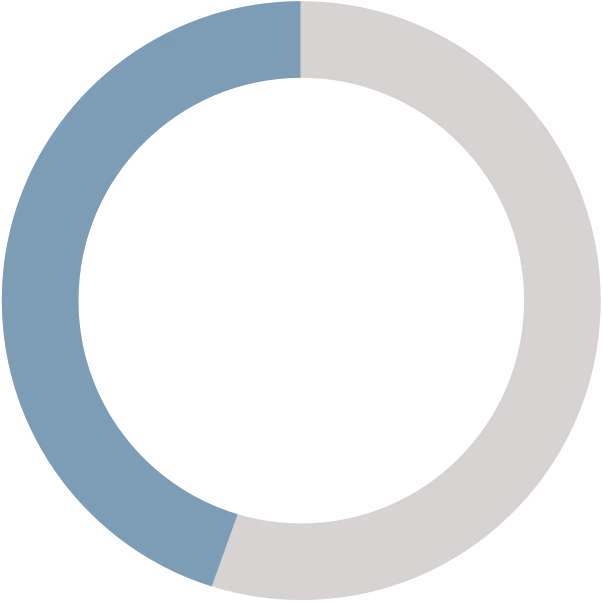

15

investments

2,050

Housing Units Financed

70%

Of Affordable Housing Units

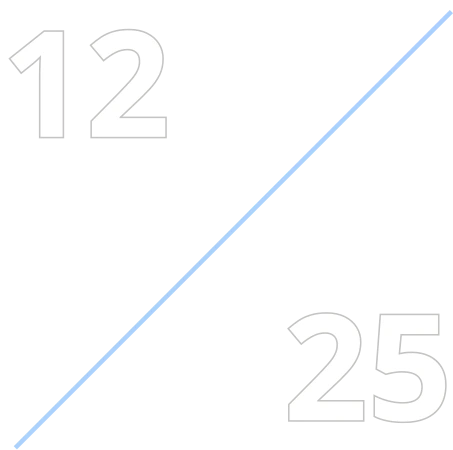

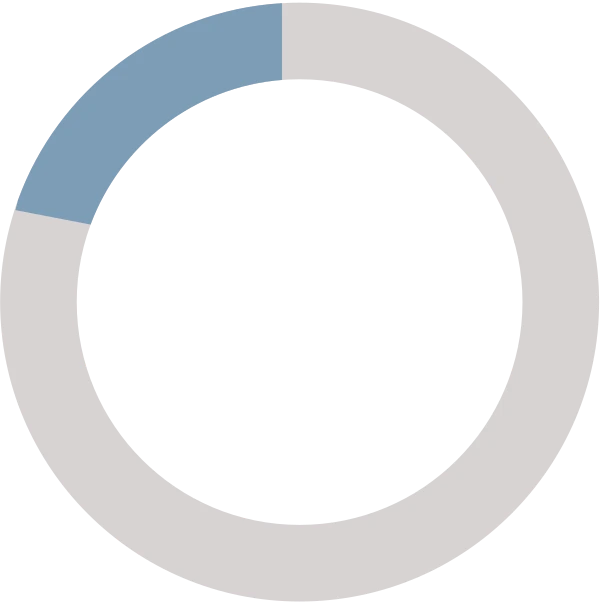

11

investments

4,975

Housing Units Financed

90%

Of Affordable Housing Units

Fund Capital Snapshot

ASREF’s principal purpose is to provide funding in the types of general projects meeting the criteria listed below:

GEOGRAPHY

AL, AR, FL, GA, LA, MS, NC, SC, TN, and TX (up to the greater of $30 million and 10% of the capital commitments may be invested in the adjacent states of KY, MO, OK, NM, and VA)

PRODUCT TYPE

Diversified across product type: Multi-family, mixed-use, industrial, office, retail, hospitality, educational, medical and other.

TARGET PROJECT SIZE

11% to 14% net IRR to the Limited Partners2

TARGET INVESTMENT SIZE

$2M to $15M, subject to certain investment restrictions

INVESTMENT STRUCTURE

Mezzanine debt, preferred equity or joint venture equity. ASREF is primarily a preferred equity/mezzanine fund but the available capital and financing can be structured to meet the needs of the sponsor. Returns are commensurate with the level of risk.

TARGET INVESTMENT PERIOD

2-4 Years Hold Period

COMMUNITY REINVESTMENT ACT (“CRA”)

All investments are intended to achieve community and economic development impacts. The Fund seeks projects that could receive positive CRA consideration (in emerging low- to moderate-income census tracts or projects that benefit low- or moderate-income persons).

The Partners: Proven Success

In 2014, Deborah La Franchi, founder of SDS Capital Group, and David Alexander, CEO of Vintage Realty Company, co-founded American South Capital Partners (ASCP) to leverage their complementary backgrounds in capital allocation and real estate development.

Deborah La Franchi

David Alexander

Deborah La Franchi

SDS CAPITAL GROUP

Los Angeles, CA

- 2001 Founded

- 100% Woman Owned

- $1.7B Current AUM; $2.5B incl. total historic funds

- 80 Investments in the US

- 34 Investments in the South

- UNPRI Signatory

- 7x IA50 recipient

David Alexander

VINTAGE REALTY COMPANY

Shreveport, LA

- 1988 Founded

- 17.5% Investor weighted avg. IRR

- $1B+ 18 properties multifamily 64 properties commercial

- 200 Team members

- 3,700 Multifamily housing units (~$750M)

- 3.0M SF Retail/office/industrial (CRE: ~$340M)

- Full Service Real estate development/ mgmt.

Vintage Realty Company Founded

Real estate developer and manager in Shreveport, LA. Current portfolio over $1B. Investor-weighted avg. IRR 17.5%.

SDS Capital Founded

Platform of impact funds across the US generating market rates of return. Over $1.7B AUM 54 investments in the South with $607M of SDS capital invested.

SDS / Vintage Connection

SDS and Economic Innovation launch (as consultants) the Northwest Louisiana Community Fund; Ms. La Franchi and Mr. Alexander meet each other as he taps this fund for impact developments.

ASCP Partnership Formed

Debbie La Franchi and David Alexander combine the synergistic skills of Vintage and SDS to form ASCP.

Launch of

ASREF I

$58M Fund Size, 15 Investments.

Launch of

ASREF II

Close of

ASREF II

$174M Fund Size as of October 2024, 10 Investments

Launch of

ASREF III

Vintage Realty Company Founded

Real estate developer and manager in Shreveport, LA. Current portfolio over $1B. Investor-weighted avg. IRR 17.5%

SDS Capital Founded

Platform of impact funds across the US generating market rates of return.Over $1.7B AUM 54 investments in the South with $607M of SDS capital invested

SDS / Vintage Connection

SDS and Economic Innovation launch (as consultants) the Northwest Louisiana Community Fund; Ms. La Franchi and Mr. Alexander meet each other as he taps this fund for impact developments.

ASCP Partnership Formed

Debbie La Franchi and David Alexander combine the synergistic skills of Vintage and SDS to form ASCP.

Launch of

ASREF I

$58M Fund Size, 15 Investments.

Launch of

ASREF II

Close of

ASREF II

$174M Fund Size as of October 2024, 10 Investments

Launch of

ASREF III

How ASREF.

is Making a Difference

ASREF invests in low-income, most often – distressed communities of color – that confront severe affordable-housing crises. These investments transform communities and the lives of the tenants while offering financial opportunity to investors aligned with this vision.

67%

NON

WHITE

39%

AFRICAN

AMERICAN

29%

POVERTY

RATE

69%

AREA MEDIAN

INCOME

WOMAN OR MINORITY

PROJECT SPONSORS

13%

UNEMPLOYMENT

RATE

ASREF Latest News

“When Debbie and I partnered SDS and Vintage on this effort back in 2014, we knew we were going to make a difference to communities of need and meet our investors return needs – now we are seeing, with the gap in affordable housing in the market, we need more focus on this segment of the market than ever before.

David Alexander, Managing Partner

ASCP and CEO Vintage Realty Group