Commentary: Why invest in affordable housing? Why now?

October 30, 2025 11:20 AM. by By Deborah La Franchi

“Don’t invest in affordable housing because it is good for communities – invest because it’s good for

your portfolio.”

This has long been my response to skeptical institutional investors who have dismissed affordable

housing as a socially-motivated endeavor that has little standing as a fiduciary-worthy investment.

The perception that an investment in affordable housing could not generate alpha for their portfolios

has long been held. However, over the past 24 months, that perception has begun to change, driven by powerful economic and demographic forces that have turned a social challenge into a compelling financial opportunity.

Performance and resilience of affordable housing is driven by a historic shortage of units

Unless you have failed to visit any urban American city over the past five years, this fact will be of no surprise: There is an estimated shortage of seven million affordable and available housing units across the U.S. today. This gap continues to widen.i The consequences have been severe: housing instability, rising homelessness and families burdened by high rents.

The affordable housing crisis is not just spilling into housing policy debates; it is routinely becoming the centerpiece of politics – as we are now witnessing in the current New York mayoral election. In Los Angeles, where I live, I can drive a quarter mile in any direction and find myself confronted by a dystopic and tragic homeless encampment that cries out for new solutions. This situation is a wake-up call for what happens when communities achieve crisis levels of unaffordability. In Los Angeles County, the affordable housing crisis has become one of the key contributors to the current 72,000ii + people living on the streets.

Regrettably, this shortage is worsening as housing production slows. Higher interest rates and inflation have made new development far more expensive. Construction lending rates have jumped over the past few years from ~4.5%-5.5% (2018) to as high as~ 7.5%-8.0%, while the cost of materials such as concrete and steel has surged by more than 28% and 65%, respectively.

These financial pressures have pushed developers to migrate towards higher income multifamily projects where elevated rents can more effectively offset higher construction costs. A recent snapshot, which compares projections for the next three years, illustrates what is occurring. Between 2022 and present day, roughly two million units of multifamily housing have been built nationwide with 25% of those units (500,000) being affordable to families earning less than 80% of area median income (“AMI”).ii For reference, 80% of the nationwide median income is just over $67,000iv – in line with earnings for teachers, therapists, flight attendants, construction and building inspectors, property managers and industrial mechanics.v Those past few years stand in great contrast to what is expected to occur over the next three years due to increasing costs. From 2024 to 2027, just one million new units are projected to come online (half of the prior three-year period), and in 2029 a full 98% of constructed units are expected to be high-income apartments.iii This scenario sets the stage for a dramatic reduction in the production of affordable housing.

These shortages, coupled with the steep slowdown in affordable housing production, are major contributors to over 50% of U.S. renter households being cost burdenediii – spending more than 30%

of their income on housing. In most communities, the low inventory of lower cost housing alternatives, coupled with the limited number of new units being built, adds to this crisis.

This precipitous drop in housing affordability has resulted in a market dislocation that, conversely, creates a significant market opportunity for institutional investors to benefit their portfolios – as well as communities.

The opportunity – and the performance data behind it

Over decades, financing for affordable housing has predominantly fallen within the purview of government agencies, nonprofits, and foundations. This reality helped cement the misconception that financing affordable housing was misaligned with the needs of institutional portfolios. More recently, affordable housing has begun to attract serious attention from institutional investors as they consider fund managers that focus on this niche investment strategy. The data on the performance and resilience of this asset class, as well as the growing number of managers executing in this space, have been key catalysts behind this growing interest.

A range of recent studies from the National Bureau of Economic Research, RCLCO, Nuveen, and the National Council of Real Estate Fiduciaries (NCREIF) have aligned findings, often centering on how affordable housing assets exhibit lower vacancy and tenant turnover rates and have a lower correlation to macroeconomic swings compared to multifamily housing targeting higher income tenants.

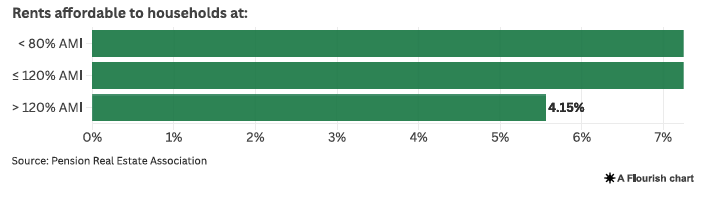

A 2024 study by the Pension Real Estate Association (PREA) found that over a 16-year period (Q1 2008 – Q1 2024), the unlevered average annual return of the most affordable properties serving households at or below 80% AMI outperformed those serving households above 120% AMI by 239 basis points.vi The primary reason cited for this is lower vacancy rates due to more limited tenant turnover.

Performance of most affordable housing vs. least affordable

Compound average annual return – Ql 2008 to Ql 2024

Our investment experience at American South Capital Partners mirrors these findings. In cost burdened communities, where over 30% of households spend more than 30% of their income on housing, the demand-supply gap is glaringly obvious. Newly constructed units lease up rapidly, often with waitlists forming before construction is complete. Once leased, tenants are much less likely to leave, given the scarcity of alternatives at similar price points.

Unlike many real estate asset classes, our team regularly witnesses how market demand for affordable housing increases with macroeconomic uncertainty. Families tighten budgets, seeking stability and lower rents, which contributes to the resilience of affordable housing as a niche investment opportunity.

A niche market with a growing track record

Twenty years ago, there were few investment vehicles within this space for institutional investors to consider. Early pioneers – such as the Genesis Workforce Housing Fund, which I helped launch – were testing unproven theses. Since then, the landscape has dramatically changed. A growing cohort of specialized managers who have launched affordable housing platforms now have a track record of more than a decade within this space, providing investors with the performance data they need to evaluate these options.

Peter Braffman, managing director on the real estate investments team at GCM Grosvenor, and one of our most recent investors and strategic partners, has pointed out how his own perception of affordable housing has changed over time: “Before the global financial crisis, we didn’t view this strategy as compatible with traditional institutional investing, whether from a return standpoint or in terms of providing sufficient liquidity for shorter-duration vehicles. Today, we see it very differently – and far more positively.”

Over the past decade, sponsors acquiring and rehabilitating affordable housing – as well as those constructing new projects (collectively referred to below as “developers”) – have increasingly utilized private-sector debt and equity. More developers perceive the pace of public-sector investment at the federal level as slowing substantially over the years – or being eliminated – and have opted to tap into private capital.

Properly structured, private capital is faster and more flexible than government or nonprofit funding sources. Securing public sector, foundation and nonprofit financing can often take four to seven years while private capital can move into projects within a matter of weeks or a few months. Affordable housing developers value the speed, flexibility, and scalability that private equity real estate investment platforms can provide. They also appreciate having equity partners that deeply understand the ecosystem of affordable housing – given the many nuances and complexities involved to make a capital stack work.

While many developers have recently been shying away from federal subsidies, we see a growing number of local and state incentive programs being created to mitigate housing affordability challenges. Developers interested in taking advantage of these programs are finding that these incentives can be quite accretive to their project bottom line. Utilizing private equity real estate funds enables these developers to move quickly once they leverage into these more straightforward local and state programs (compared to complex federal programs).

The most successful developers in this space are those who are adept at pivoting as the market shifts. Many have refined replicable construction models for greater cost and time frame efficiency, built

specialized contractor and subcontractor relationships, or deployed new technology that reduces both development and operating costs. Such innovative development strategies are most successful because they seek out opportunities even in uncertain markets.

Why now?

Investing in affordable housing, due to the range of factors noted above, is increasingly viewed as a solid and strategic option for sponsors seeking more conservative, resilient, and niche strategies that are less correlated to the macro economy. And, for investors who might be overexposed to high income housing, affordable housing offers a diversifying opportunity.

Affordable housing is not just a moral imperative for society. It’s also an investment opportunity hiding in plain sight.

Deborah La Franchi is CEO and founder of SDS Capital Group and managing partner of American South Capital Partners. This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&l’s editorial team.

i National Low Income Housing Coalition, Gap Report;

ii Los Angeles Homeless Services Authority, Greater Los Angeles Homeless Count 2025

iii PERE News, Grubb Properties: America Is Getting Squeezed in the Middle

iv U.S. Census Bureau, Housing Reports

v U.S. Bureau of Labor Statistics, OES, May 2024 data for relevant occupations (Therapists; Teachers, Flight attendants; Construction inspectors, Property managers; Mechanics).

vi U.S. Pension Real Estate Association, Report